From today, the level of Coronavirus Job Retention Scheme (CJRS) grant will be reduced. Employers will now be asked to contribute towards the cost of any furloughed employees’ wages.

To be eligible for the grant, you must continue to pay furloughed employees 80% of their wages, up to a cap of £2,500 per month for the time they spend on furlough.

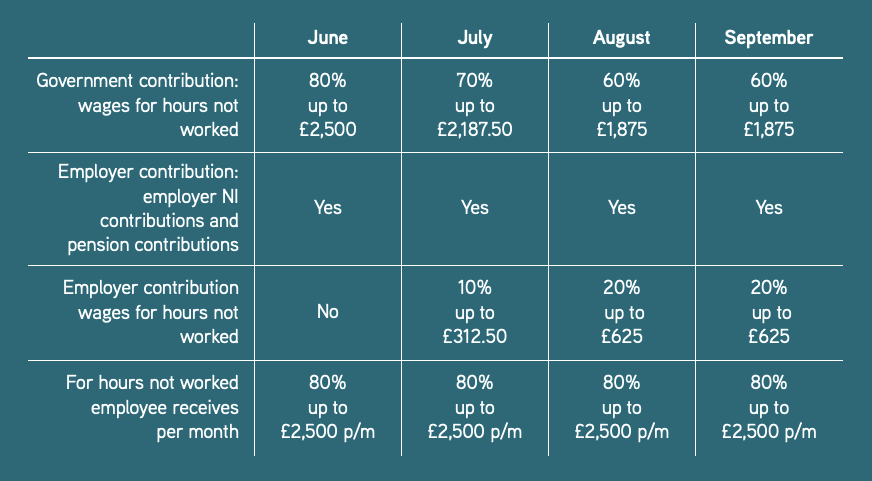

The table below shows the level of government contribution available in the coming months, the required employer contribution and the amount that the employee receives per month where the employee is furloughed 100% of the time.

Wage caps are proportional to the hours not worked.

You can continue to choose to top up your employees’ wages above the 80% total and £2,500 cap for the hours not worked at your own expense.

If you would like further help or advice, please do get in touch.

Latest Link: Make the most of tax-saving opportunities before the 2023/24 tax year end